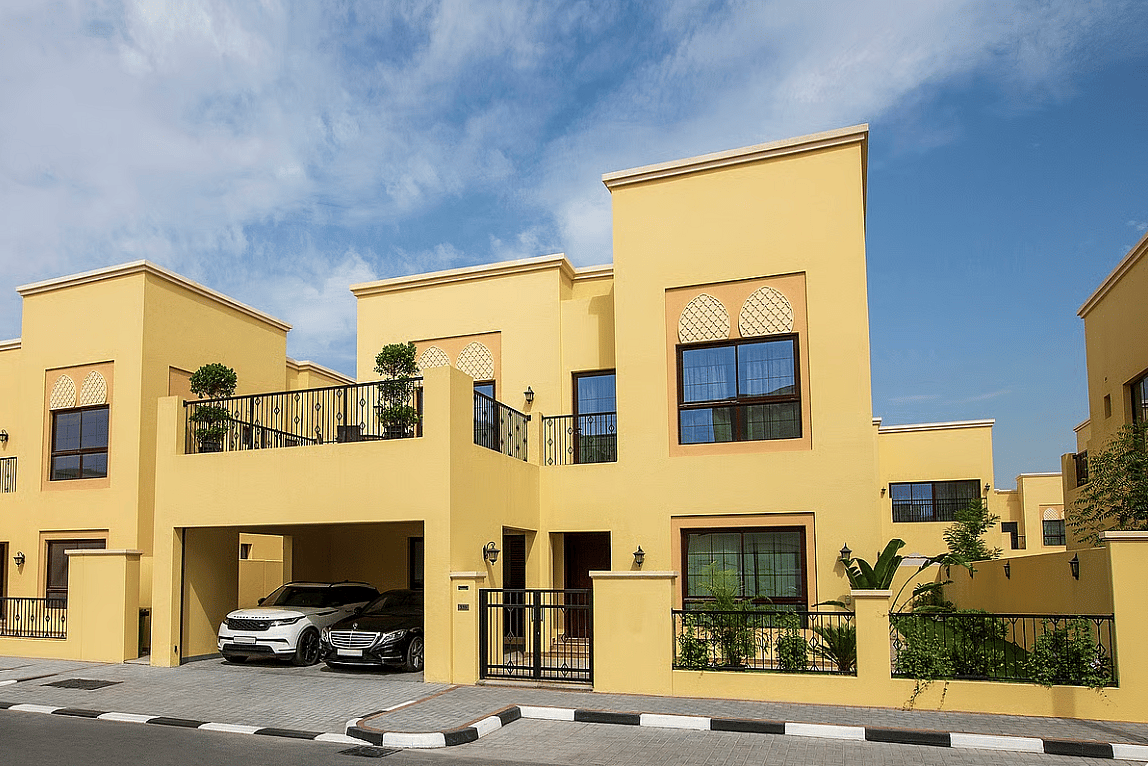

Villas are rising as the following massive factor amid Dubai’s practically five-year property rally. With a 16 per cent year-on-year development in costs, villas led the cost as total residential costs jumped greater than 13 per cent in comparison with 2024.

World property consultancy Knight Frank stated Q2 2025 marked a “historic excessive” in each transaction volumes and values. The April-to-June interval noticed over 51,000 house gross sales — “an all-time quarterly file.”

Faisal Durrani, Companion – head of analysis, Mena, stated a section to observe is the villa market. “Simply 20 per cent of the deliberate housing provide by to the top of 2029 will fall within the villa class, and with demand remaining centred on stand-alone household houses, the delta between villa and residence value efficiency might nicely proceed to widen.”

Keep updated with the most recent information. Observe KT on WhatsApp Channels.

When the Covid-19 pandemic hit, patrons targeted on securing bigger houses, with more room for a house workplace, a house fitness center, and/or out of doors area. “Extra importantly for Dubai, there was unrelenting demand from worldwide rich patrons trying to safe the town’s most costly houses, which are usually stand-alone, beachfront properties,” Durrani instructed Khaleej Instances.

Villas outperformed the broader market, with values climbing to Dh2,172 per sq. foot — a 4 per cent enhance over the quarter. Villas are more likely to stay briefly provide over the medium time period, and the value efficiency of this section is anticipated to proceed outperforming residences.

“The truth is, villa costs at the moment are 49.3 per cent above 2014 peak ranges, whereas residence costs are up by 17.5 per cent over the identical interval.”

High areas for villas

Villa value development has been robust throughout each the luxurious and inexpensive ends of the market.

“In Q2 2025, the very best quarterly development was recorded in Victory Heights, Al Barari, Jumeirah Park, and Dubai Hills Property, with common value will increase ranging between 8-10 per cent. Al Barari and Dubai Hills, now firmly established as prime villa markets, proceed to see robust demand pushed by their life-style choices and restricted provide,” stated Durrani.

Annual figures present that the highest performers embrace the extra accessible areas of Inexperienced Neighborhood West, Al Furjan, and Emaar South, together with the prosperous communities of The Meadows and Arabian Ranches.

Who’re the patrons?

Will McKintosh, Regional Companion – Head of Residential, MENA, stated the market is more and more being formed by real patrons reasonably than speculators, with resale exercise inside 12 months of buy now at simply 4-5 per cent, in comparison with 25 per cent in 2008.

Durrani defined there’s far much less speculative market exercise in the present day in comparison with the 2 earlier cycles, which had been underpinned by ‘buy-to-flip’ exercise. “A metric we use to gauge market hypothesis is the proportion of houses resold inside 12 months of acquisition. Throughout 2008/09, this determine stood at 25-30 per cent, in comparison with nearer 4 per cent in the present day, highlighting that there are extra real finish customers available in the market, along with long-term ‘buy-to-let’ or ‘buy-to-hold’ buyers. Given the altering dynamic of patrons — a lot of whom are households — demand for villas stays robust.”

5 years of development in costs

The overall worth of residential gross sales in H1 reached Dh268 billion, a 41 per cent enhance in comparison with the identical interval final 12 months. Knight Frank predicts that 2025 will surpass the Dh367 billion achieved in 2024.

Citywide residential costs rose by 3.4 per cent in Q2 2025, reaching a median of Dh1,809 per sq. foot. This locations present values 21.6 per cent above the earlier market peak recorded in 2014.

“The sustained development in costs — now approaching 5 consecutive years because the present cycle started in November 2020 — is a transparent signal of a extra steady and predictable market surroundings,” stated Durrani. “Knight Frank’s forecasts for 2025 stay unchanged, with 8 per cent development anticipated within the mainstream market and 5 per cent within the prime section.”

Off-plan gross sales accounted for practically 70 per cent of all transactions in Q2. “Prime residential areas equivalent to Palm Jumeirah, Emirates Hills, Jumeirah Bay Island, and Dubai Hills Property stay essentially the most sought-after areas, notably amongst worldwide high-net-worth people.”