Cardano value isn’t escaping the broader market’s sell-off. The Cardano value has dropped 7.6% up to now 24 hours, trimming a lot of its current beneficial properties. But, on a month-to-month scale, ADA continues to be up 28.6%, leaving merchants caught between optimism and worry.

Behind the scenes, a much bigger battle is taking part in out: tremendous whales are promoting, retail holders are staying bullish, and brief sellers are piling in on derivatives markets. With all three forces pulling ADA in numerous instructions, one issue may in the end determine who comes out on prime.

Tremendous Whales Trim Holdings as Community Exercise Declines

On-chain information reveals Cardano’s greatest wallets, holding from 1 billion ADA as much as infinity, have reduce their holdings from 5.43% in late June to five.02% now, signaling a transparent bearish tilt from main gamers. Though the proportion dip doesn’t learn a lot, even a half-a-percent drop is huge with regards to whale holdings.

Including to this strain, energetic addresses on the Cardano community are sliding, per the month-to-month chart. Addresses are down over 40% since peaking on 18th July, at 42,000.

This drop coincided with the ADA value dip, as the height preceded the native prime of $0.92. The drop in addresses may be one of many causes for the whale apathy.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Retail Stays Bullish Whereas Brief Strain Builds

Regardless of whales trimming their stakes, retail merchants stay assured, with netflows from exchanges staying damaging for months, that means extra ADA is being withdrawn than deposited. Usually, that is bullish; it reveals holders are accumulating, not promoting.

However derivatives merchants are siding with the whales. Bitget’s 30-day liquidation map reveals $141.7 million in brief positions versus simply $74 million in longs, a transparent guess that ADA’s value has extra room to fall. And these merchants are clearly turning bearish. This explains the three-way battle: that includes whales, retail, and leverage merchants.

If whale dumping continues, shorts may take management, driving ADA decrease and forcing extra liquidations. However a sudden brief squeeze, led by retail sentiment, may flip the script, letting optimism win.

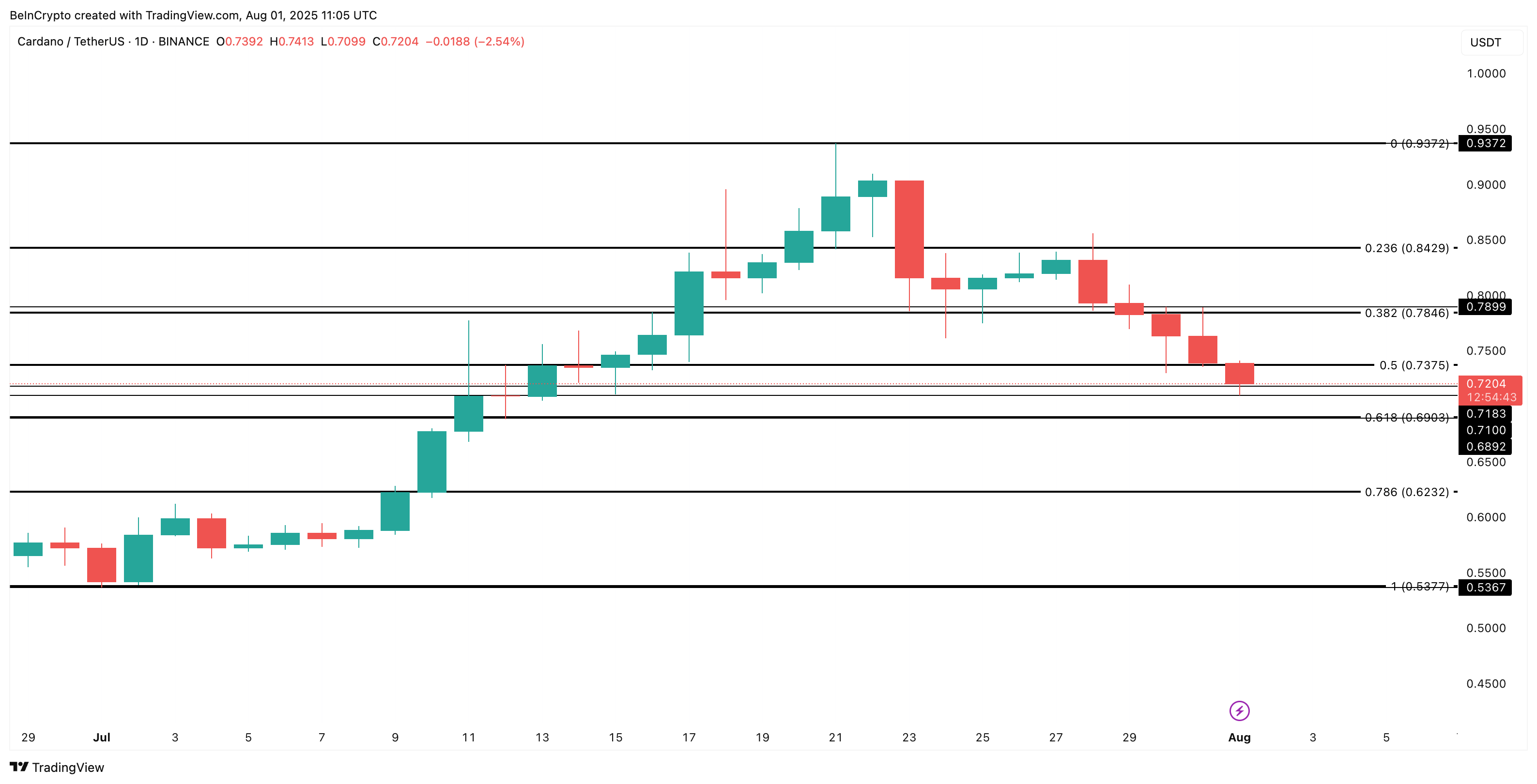

Key Cardano Value Ranges in Focus

ADA is hovering close to essential help ranges at $0.71 and $0.68. A breakdown may drag costs to $0.62, matching the bearish whale and brief positioning. Based mostly on the liquidation map, a drop to $0.62 will liquidate no matter lengthy positions stay.

But when bulls reclaim $0.73 and $0.78, momentum may flip again to the upside, invalidating the bearish speculation. That would then set a push towards $0.84 and $0.93, in favor of retail. Additionally, that will liquidate the brief positions.

For now, the market stays in a standoff, with whales trimming, retail holders clinging on, and derivatives merchants ready for a breakdown to revenue. One issue, whether or not the short-heavy positioning triggers a squeeze or provides strain, may quickly determine who wins this battle for Cardano’s subsequent massive transfer.

Disclaimer

In step with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.